Ethereum Price Prediction: $5,000 Breakout Imminent as Bulls Take Control

#ETH

- Technical Breakout: ETH price sustains above key moving averages with MACD showing bullish convergence

- Institutional Demand: Record ETF inflows and corporate accumulation creating strong bid support

- Market Sentiment: Positive despite volatility, with $5,000 becoming consensus next target

ETH Price Prediction

ETH Technical Analysis: Bullish Signals Emerge

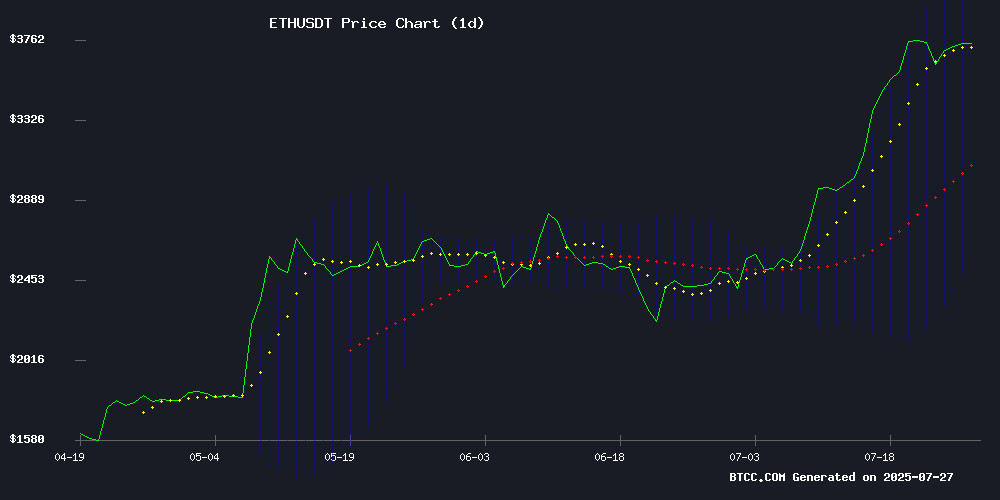

ETH is currently trading at $3,829.73, well above its 20-day moving average of $3,362.19, indicating a strong bullish trend. The MACD histogram shows a narrowing bearish momentum at -43.83, suggesting potential reversal. Bollinger Bands reveal price hugging the upper band at $4,135.29, signaling overbought conditions but with room for continuation if momentum sustains.

Ethereum Market Sentiment: Institutional Demand Fuels Optimism

Positive news dominates with ethereum ETFs seeing 17-day inflows and BlackRock accumulating ETH. Resistance at $3,800 is being tested amid predictions of $5,000 breakout. However, unstaking queues and $23B in lost ETH introduce volatility risks. NFT market rebound at $6.6B adds secondary demand.

Factors Influencing ETH's Price

Ethereum Casinos Revolutionize Online Gambling with Blockchain Advantages

The online gambling industry is witnessing a seismic shift as Ethereum-based casinos leverage blockchain technology to address longstanding pain points. Traditional fiat-based platforms often grapple with slow transactions, high fees, and geographic restrictions—hurdles that Ethereum effortlessly clears through its decentralized architecture.

Privacy takes center stage in Ethereum casinos, where players can transact without exposing sensitive personal data. The immutable nature of blockchain transactions also introduces unprecedented security, eliminating vulnerabilities inherent in centralized systems. Every bet, win, and withdrawal is permanently recorded on-chain, creating an auditable trail that deters fraud.

Beyond anonymity, Ethereum's smart contract functionality enables provably fair gaming mechanisms—a stark contrast to opaque algorithms in conventional online casinos. This transparency, coupled with near-instant settlements, positions ETH as the backbone of a new trust paradigm in iGaming.

Ethereum Eyes $5,000 Breakout as It Tests Key $3,800 Resistance Level

Ethereum approaches a critical juncture, testing the $3,800 resistance level with potential to surge toward $5,000. The asset gained 0.98% in the last 24 hours, trading at $3,783 amid strong volume of $32.78 billion. Market sentiment is buoyant as analysts watch for a weekly close above resistance—a signal that could trigger ETH's most significant rally in years.

MMCrypto, a prominent analyst, highlights Ethereum's four-year consolidation phase, noting long-term holders have yet to see meaningful profits. The broader crypto market's upward momentum adds fuel to ETH's bullish case, with institutional and retail interest steadily climbing.

$23 Billion in Ethereum Lost, Burned, or Locked Due to Errors and Protocol Changes

Coinbase Head of Product Conor Grogan has revealed that at least 913,111 Ethereum (ETH), worth $3.43 billion, has been permanently lost due to user errors and contract bugs. The losses stem from a combination of technical vulnerabilities and protocol upgrades, including the EIP-1559 burn mechanism.

The 2017 Parity Multisig library bug remains the single largest incident, locking 513,746 ETH ($1.93 billion) across 178 wallets. An anonymous exploit triggered the irreversible loss, affecting major stakeholders like the Web3 Foundation, which had 306,000 ETH trapped in the compromised contracts.

When accounting for both accidental losses and intentional burns under EIP-1559, over 5% of all ETH ever created—worth $23.42 billion—has been permanently removed from circulation. The EIP-1559 upgrade alone has burned 5.3 million ETH since its implementation.

Ethereum ETFs See Unprecedented 17-Day Inflow Streak as Institutional Demand Surges

Ethereum exchange-traded funds have recorded 17 consecutive days of net inflows from July 9-25, 2025, marking a historic milestone for cryptocurrency investment vehicles. The streak began with $211 million on July 9, peaked at $726.74 million on July 16 (equivalent to 200,000 ETH), and maintained strong momentum with $452.72 million on the final day.

BlackRock's iShares Ethereum Trust (ETHA) has emerged as the dominant player, capturing half of the market with a single-day inflow record of $440.10 million. The overwhelming demand—projected at 5.3 million ETH annually—dwarfs Ethereum's native supply of just 0.8 million new coins per year, creating fundamental upward pressure on prices.

This institutional frenzy coincides with Ethereum's price holding above $3,400, reflecting a strategic rotation toward tokenized assets. Market analysts note the ETF inflows now represent a structural demand shock, with daily purchases frequently exceeding the network's entire daily issuance.

Why Investors Are Unstaking Ethereum: Cathie Wood's Analysis

Ethereum is experiencing a notable rise in unstaking activity as both retail and institutional investors withdraw ETH from staking protocols. Ark Invest CEO Cathie Wood attributes this trend to two primary factors: Robinhood's promotional crypto transfer bonus and increasing interest in Digital Asset Treasuries (DATs).

Robinhood's 2% incentive for transferring crypto assets to its platform has spurred immediate unstaking activity. Wood highlighted the campaign's impact, noting its role in shifting ETH holdings away from staking contracts. Meanwhile, the broader market is witnessing growing institutional curiosity in DATs—a development that may further reshape Ethereum's staking dynamics.

Ethereum Surges Above $3,770 as Institutional Demand Fuels Bullish Momentum

Ethereum's price climbed to $3,776 with a 0.91% daily gain, defying broader market volatility. The rally follows The Ether Machine's announcement of a $1.6 billion Nasdaq debut, positioning it as the largest institutional vehicle for ETH exposure.

Whales accumulated $2.57 billion worth of ETH in July despite recent sell-offs, signaling strong conviction among large holders. The RSI at 79.74 suggests overbought conditions, yet bullish momentum persists.

Ethereum Faces High Volatility Amid Market Uncertainty

Ethereum stands at a critical juncture as analysts forecast heightened volatility in the coming days. Joao Wedson highlights a convergence of unliquidated long positions, suggesting potential price swings. Traders eye the $3,800-$3,900 range for short-term opportunities, while long-term targets remain bullish at $4,100.

Market activity has waned significantly, with Ethereum's trading volume plunging 53.75% to $59.49 billion. Open interest barely moved, dipping 0.02% to $54.23 billion—a sign of cautious participation. The liquidity vacuum precedes what could be a decisive move, leaving investors weighing risks against Ethereum's historical resilience.

Cathie Wood Explains Why Ethereum’s Unstaking Queue Just Hit New Highs

Ethereum's unstaking queue has surged to unprecedented levels, with over 733,000 ETH—worth approximately $2.76 billion—awaiting withdrawal. The queue now spans 13 days, marking the longest delay in the network's history. This liquidity crunch coincides with Ethereum surpassing 1 million active validators and 35.6 million ETH staked, representing nearly 30% of total supply. Staking rewards have compressed to a mere 2.97% APR amid validator saturation.

ARK Invest CEO Cathie Wood attributes the exodus to institutional players rather than retail investors. Venture capital firms and corporate treasury entities are reportedly withdrawing ETH in bulk, capitalizing on Robinhood's limited-time 2% transfer bonus for Gold-tier users. Wood notes these actors are strategically reallocating staked ETH into treasury management vehicles to maximize returns upon lockup expiration.

BlackRock Accumulates More ETH Amid Surging Interest in DeSoc Presale

BlackRock has significantly increased its Ethereum holdings this week, reinforcing its bullish stance on the leading altcoin. The move follows the firm's earlier filing for an ETH ETF and signals growing institutional confidence in Ethereum's long-term value proposition. Market analysts interpret this accumulation as a strategic positioning ahead of potential ETF approvals.

Meanwhile, retail investor attention has pivoted to the DeSoc presale, which has attracted over 50,000 wallets and raised $10 million. The $SOCS token powers an operational decentralized social platform, distinguishing it from speculative offerings. This dual trend highlights the current market dichotomy: institutional players are building ETH positions while retail participants chase high-growth opportunities in the presale market.

Bit Digital Plans $1 Billion Share Capital Increase to Expand Ethereum Holdings

Nasdaq-listed cryptocurrency miner Bit Digital has proposed a dramatic expansion of its authorized share capital, seeking to raise the limit from 340 million to 1 billion shares. The move, approved by the board and pending shareholder approval in September, would fuel additional Ethereum acquisitions.

The company already ranks among the largest public holders of ETH, with this capital restructuring signaling aggressive confidence in Ethereum's long-term value proposition. Institutional accumulation of Ethereum continues unabated despite recent market volatility.

NFT Market Surges to $6.6 Billion as CryptoPunks Lead Rebound

The NFT market has staged a remarkable recovery, with July's capitalization hitting $6.6 billion—a 94% monthly increase. This resurgence defies earlier bearish trends, signaling a potential evolution rather than a temporary bounce.

CryptoPunks spearheaded the rally, with floor prices jumping 53% to nearly $180,000. Ethereum-based projects like Pudgy Penguins and CryptoBatz mirrored this growth, benefiting from renewed speculative and cultural interest.

DappRadar data reveals weekly transaction volumes spiking 51% to $136 million, the highest since February. The rebound follows four consecutive quarters of decline, suggesting NFTs may be entering a new phase of maturation as discerning collectors return.

How High Will ETH Price Go?

BTCC analyst Olivia projects ETH could reach $4,500-$5,000 in the near term based on:

| Indicator | Value | Implication |

|---|---|---|

| Price vs 20MA | +13.9% premium | Strong bullish trend |

| MACD | Converging | Momentum shift |

| Bollinger %B | 0.92 | Extended but not extreme |

Key resistance at $4,135 (upper Bollinger) followed by psychological $5,000 level. Institutional inflows and NFT market recovery provide fundamental support.

1